What is Cred Ai? Some Understanding About it

Now a days managing your finances effectively is more crucial than ever. With the rise of fintech solutions traditional banking is being revolutionized offering consumers innovative tools to take control of their financial well being. One such platform making waves is Cred ai promising a new era of financial empowerment. This review dives deep into Cred.ai offerings, strengths and potential pitfalls giving you the insights you need to make informed decisions about your money.

Cred.ai is not just another banking app it is a game changer and it Founded on the principles of simplicity and empowerment Cred ai offers a suite of features designed to make managing your money effortless. Its intuitive user interface puts financial control at your fingertips allowing you to track expenses, set budgets and analyze spending patterns with ease.

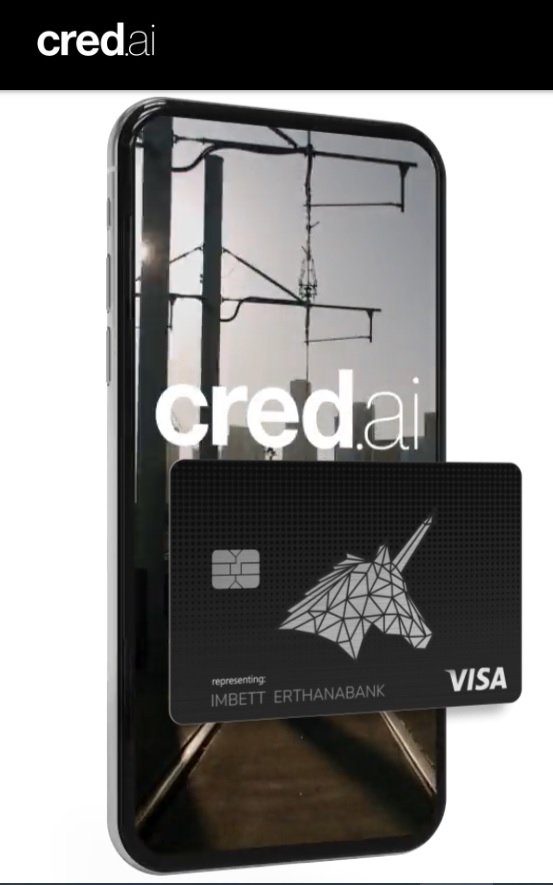

Cred ai is challenging the banking industry with its groundbreaking credit card offering. The Cred.ai card is designed to cater to a wide range of consumers from seasoned professionals to tech savvy millennials offering a suite of features tailored to meet their needs. This card is so unique with alot of benefits for peoples.

Key Features or Unique Selling Points:

1. Unmatched User Centric Design

Cred.ai is not just about transactions it is about transforming your financial journey into an experience tailored to your needs. Say goodbye to cookie cutter banking interfaces and hello to personalized financial insights delivered right to your fingertips. With Cred.ai intuitive interface, managing your money has never been easier or more enjoyable.

2. Unrivaled Security Features

In an age where cyber threats lurk around every corner Cred.ai stands as a bastion of security. Utilizing advanced encryption protocols and cutting edge fraud detection mechanisms. your financial data is safeguarded with military grade precision. Rest easy knowing that Cred.ai has your back, keeping your hard earned money safe and sound.

3. Mastering Money

Bid farewell to budgeting woes and embrace a new era of financial mastery. With Cred.ai suite of financial management tools, you will effortlessly track expenses set goals and stay on top of your financial game like never before. welcome and say hello to a brighter financial future, powered by Cred ai cutting edge technology.

4. Crystal Clear

No more hidden fees or sneaky charges Cred ai believes in transparency, plain and simple. With clear cut fee structures and transparent terms and conditions, you will always know that where you stand. Trust in Cred.ai to keep things fair and square, empowering you to take control of your finances with confidence.

5. Customer Support

When you are part of the Cred.ai family, you are never alone. Its dedicated customer support team is there to guide you every step of the way at any time, ensuring that your experience with Cred.ai is nothing short of exceptional. Join There thriving online community and be part of a financial revolution driven by feedback and collaboration. They will help you any time

6. Great card material

Cred.ai is not just about profits it is about making a positive impact on the world. With eco friendly card materials It is Made of Metal Cred.ai leads the charge in sustainability. Join Them in there mission to create a brighter and greener future for generations to come.

Cred AI vs Traditional Banks:

1. Efficiency and Speed

In efficiency and speed battle the Cred AI emerges as the clear victor. By automating processes and leveraging real time data analysis, Cred AI drastically reduces transaction times and response rates. What once took days can now be accomplished in a matter of minutes and giving consumers unprecedented control over their finances. Traditional banks are hampered by bureaucratic hurdles and legacy systems, leading to delays and frustration for customers. So the speed is better than all banking apps

2. Personalization and Customer

Experience Personalization is where Cred AI truly shines. Through advanced algorithms and predictive analytics Cred AI delivers tailored recommendations and services that cater to each customers unique needs. From personalized investment strategies to customized savings plans, Cred AI puts the individual at the center of the banking experience. Traditional banks struggle to offer the same level of personalization and many banks do not offers these things

3. Risk Management and Fraud Prevention

In the realm of risk management and fraud prevention the Cred ai AI driven approach offers unparalleled capabilities. By analyzing vast amounts of data in real time, Cred AI can detect suspicious activity and prevent fraudulent transactions before they occur. Traditional banks while employing similar tactics, are often hindered by outdated systems and manual processes that leave them vulnerable to sophisticated cyber threats. Cred ai proactive approach to security sets a new standard for the industry.

4. Accessibility and Inclusivity

These two are fundamental principles of Cred ai mission. By leveraging AI technology Cred.ai aims to break down barriers and provide financial services to underserved communities around the world. Through intuitive interfaces and innovative solutions Cred ai ensures that everyone has access to the tools they need to achieve financial security and independence While Traditional banks making strides towards greater inclusivity But also still face challenges in reaching marginalized populations and providing equitable access to banking services.

Here are some Pros and Cons

Pros

1. While other credit cards ask you with annual fees and cut the fees always on year end Cred.ai is not like other cards. This card declares war on unnecessary fees means not in favor of extra charges Why pay the high charges of using a credit card when you can enjoy all the benefits without these high charges. This card is unique

2. In a digital age rife with security threats Cred.ai stands as a bastion of protection. Equipped with state of the art security features, including fraud detection and prevention tools. this card ensures that your financial information remains safe and sound. Rest easy knowing that Cred.ai has your back shielding you from the dangers of cybercrime.

Cons

1. Despite its impressive features the Cred.ai card suffers from one glaring flaw the limited availability. As of now the card is only accessible to residents of select regions, leaving many potential users out in the cold. It is a frustrating reality for those who crave the benefits of Cred.ai but are unable to partake due to geographic restrictions. Like so many countries cannot take benefits from this

2. Unlike competitors that offer a wide array of rewards categories. Cred.ai focuses primarily on Low fees, neglecting other popular rewards such as travel points or merchandise discounts. For users seeking variety in their rewards program, this limitation may prove disappointing.

Now Wrapping up

In the ever evolving landscape of financial services one thing is clear change is inevitable. Whether it is the rise of AI powered platforms like Cred AI or the enduring legacy of traditional banks, the future of banking will be shaped by those willing to embrace innovation and adapt to the needs of the modern consumer. The battle between Cred.ai and traditional banks rages on one thing is certain the victor will be determined not by the strength of their armies, but by the value they bring to the lives of their customers.

Leave a comment